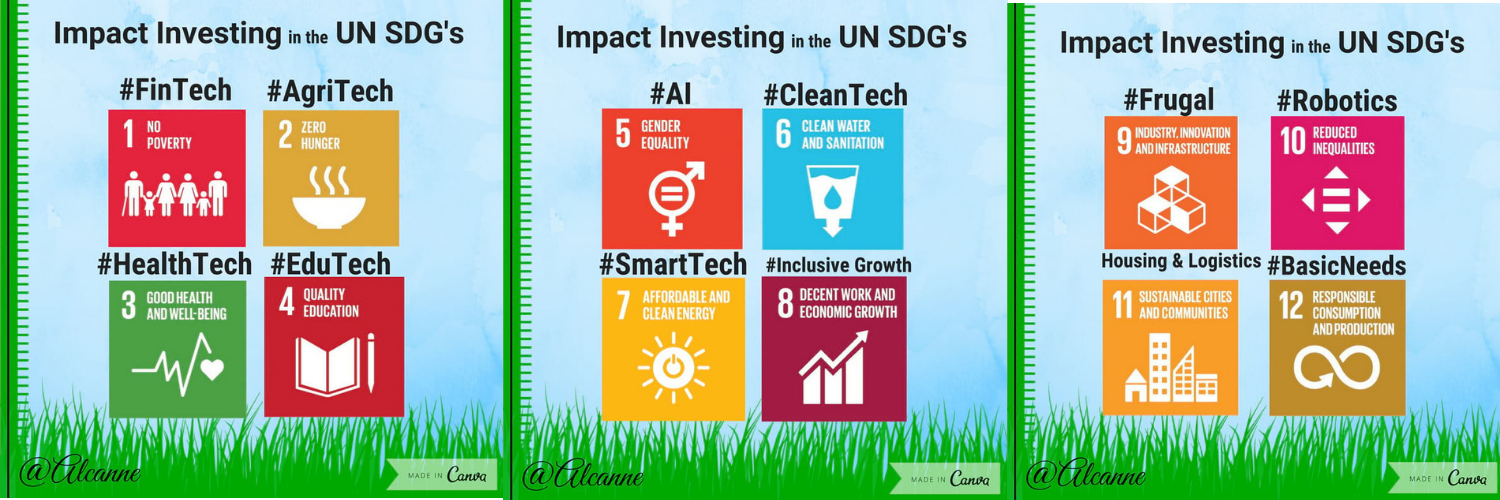

You can read more about their full approach here. There is a clear trend sweeping the world. Businesses with a mission to impact modification and make an earnings are attracting huge quantities of capital. With this wave and a newer way to do company also comes new difficulties, especially since the spectrum of “impact” is so varied.

Because impact management techniques– from defining metrics and gathering information, to examining those data and reporting to investors (and other beneficiaries)– have actually ended up being essential. With that need there has actually likewise been a rise in impact investing tasks postings and a requirement for specialists who are well versed in these data management areas (along with the tools that will assist in an effective impact method).

The following 3 strategic reasons shouldn’t be taken as the only three (Tyler Tivis Tysdal). We feel they are three of the most important, in addition to one of the most fundamental reason of all: an impact fund require to know the extent of its impact returns. With that in mind, here are the factors why we believe that determining impact can and should form a core part of the technique of impact funds.

There are some social impact funds that will not even make financial investments unless those possible assets step impact. In any case, working with possessions to make sure they have an understanding of impact measurement, and also the tools and resources (e.g. skill) to do so will make those assets better at producing that impact in the long run – Tyler Tivis Tysdal.

Million Investors State

Social impact funds also need to attract individual investors and other sources of capital so that they can bring out those allocation strategies. Tyler Tysdal Lone Tree. How might those interested celebrations who have cash in their pockets evaluate whether such a fund deserves those dollars? Just like any investment, they will evaluate how most likely is that the fund will attain its goals.

That implies exceeding showing number of dollars invested or variety of social enterprises bought, and truly showing the effects that those dollars have actually produced (Tyler T. Tysdal). What has altered in beneficiary lives since of it? That’s where impact is and where credibility lies. In standard investing, a core part of the due diligence stage includes the evaluation of monetary risk.

If we are to bring impact investing and social impact funds into the mainstream throughout the world, impact measurement needs to be a core part of that journey. Demanding impact responsibility, when performed in a collective and supportive way, helps properties step up also. If they are much better able to report on their impact, they are likewise much better able to utilize those insights to improve how they provide impact to beneficiaries.

This is the charm of impact data – Tyler Tysdal. You can put it to work to help make better financing decisions and enhance investment outcomes throughout a portfolio. We can help you arrive by using our cloud-based platforms to work together with assets in the management of those important impact information.

Fraud Racketeering Conspiracy

A lot of of the world’s issues are exacerbated by the ruthless pursuit of earnings at any expense. Recently, it’s stylish to invest billions in the next cool thing, while our overheating planet take care of itself. Tyler Tivis Tysdal – Tyler Tivis Tysdal. And it’s obvious that the most affluent people on earth are getting richer as the earnings of many people all over the world stagnate.

And investing isn’t broken. There are a lot of investors out there, people like you, who feel highly about seeing that their financial investments have both a solid return AND a positive impact. We’re hearing that more and more of you want to be included and connected with positive results. Since we all understand we can’t happen with business as typical (Tyler Tysdal Lone Tree).

We are bringing life times of investment, organisation and development know-how to the table, reconsidering both of these tried-and-true approaches. Taking a look at them with a various set of worths (Tyler T. Tysdal). In our world, effects have to deliver on the original objective in making the financial investment. Each impact business or company should meet or surpass recognized criteria (Tyler Tysdal Lone Tree).